Let's talk about student loans

Student loans aren't evil, but they're not always the right decision.

Whether loans make sense for you depends on what you're studying, where you're going, and the jobs you want.

Taking out student loans can affect your life in significant ways - sometimes negatively, and sometimes for a good portion of your working life.

Be careful when deciding to take out student loans. Do the math, and make sure it's the right decision for you.

This site has a bit of advice about how to think about taking out loans.

Questions to ask

If you're the first in your family to go to college, or having to figure this out yourself, it's normal to feel overwhelmed when thinking about taking out loans.

The most important thing you can do before deciding to take loans to attend college is to to think through a few questions:

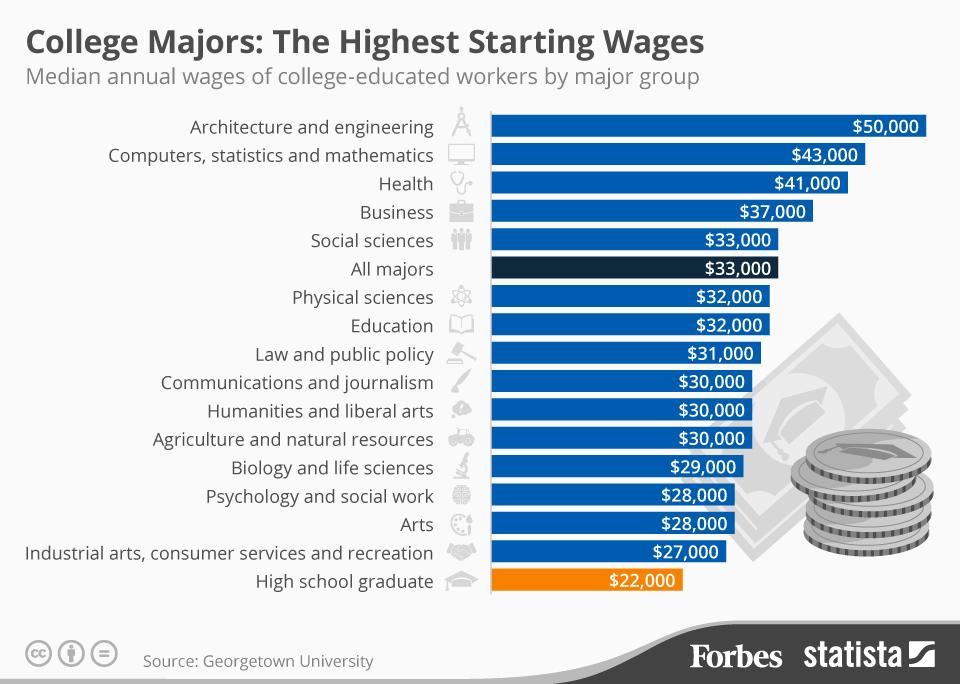

What are you majoring in? What is the return on investment for that degree?

It's important to study something you're interested in, and it's also important to make sure you're studying something that can support you.

While going to college often improves job prospects, it doesn't always guarantee you one. Depending on what you study, finding a job can range from doable to difficult.

Even after you get a job, your income can vary depending on what you study. For example, if you major in a field that has lower demand, you may need to prepare for a more difficult job hunt or the possibility of finding supplementary sources of income.

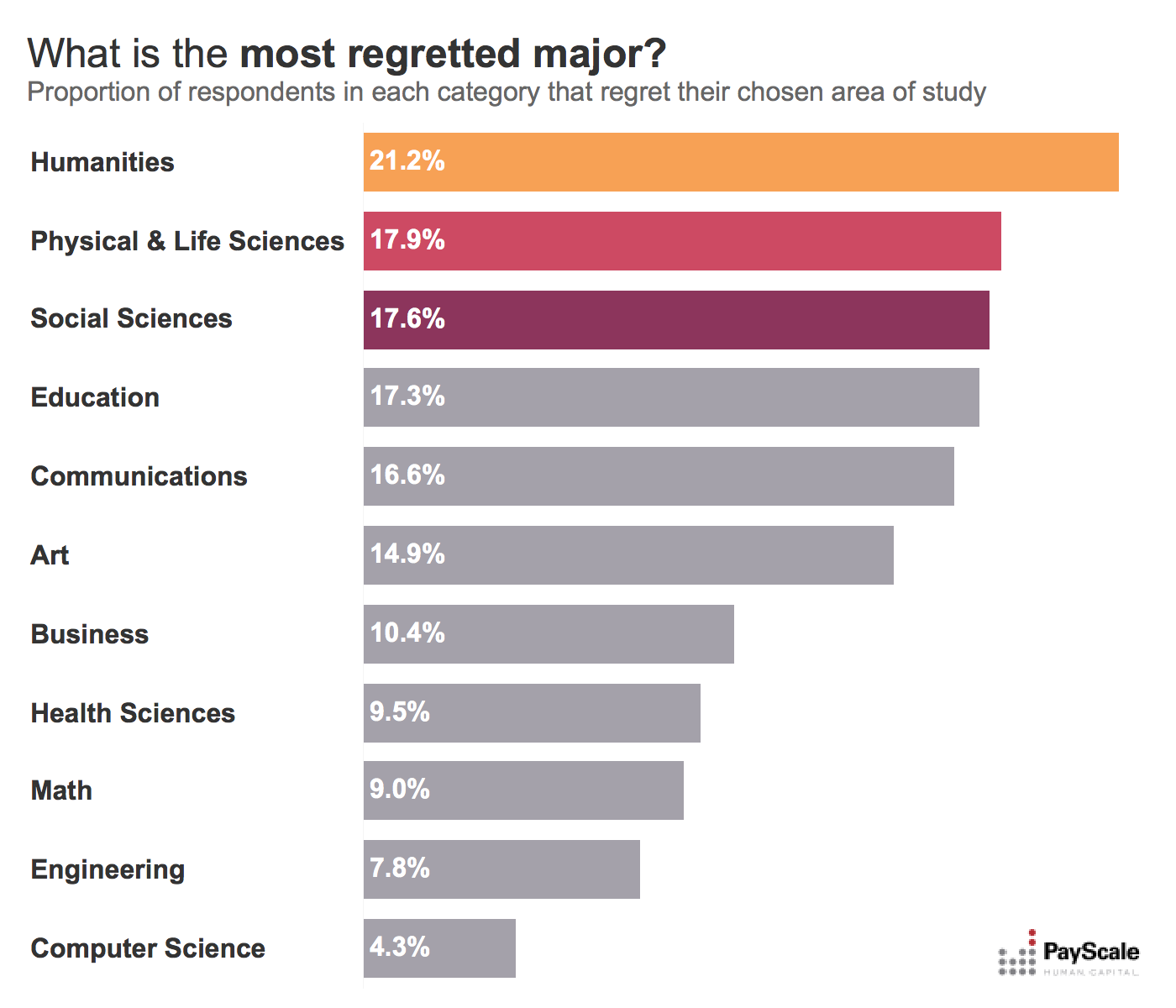

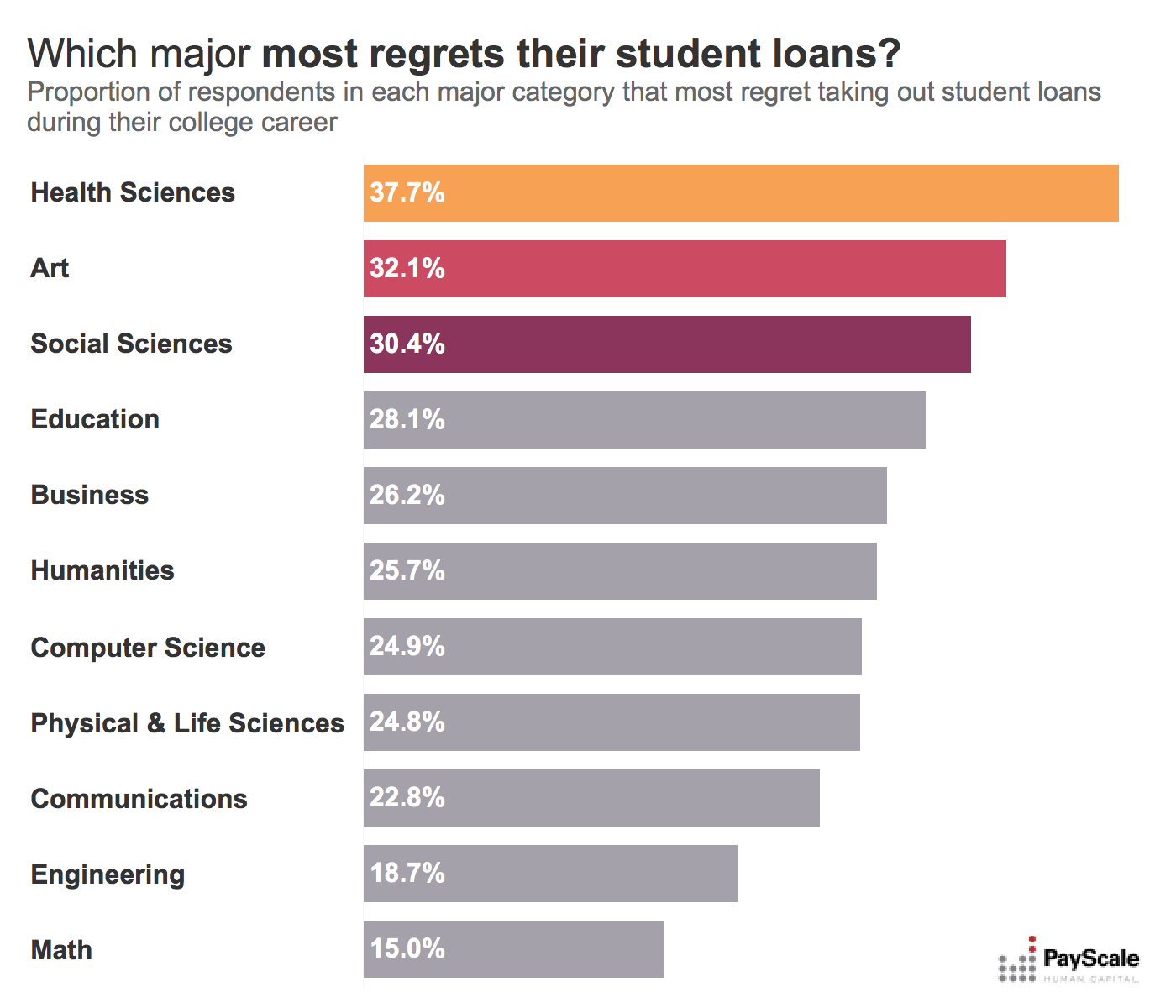

Following your passion is good, but your passion might not be fun if you're struggling to make ends meet. That happens more often than one might think: The most common regret from college graduates is they took out loans to major in a field that doesn't pay well.

Before deciding your major, look up the expected salaries of each option. Two websites where you can look up salaries are Students Review and Job Search Intelligence.

If you find that the topic you're most interested in might not be a good primary major, that's OK. One option is to have a "practical" major that you find a bit interesting, but also another "passion" minor in a topic that you're super passionate about. Then, your "practical" major can provide the financial support to pursue the interests from your "passion" minor.

Is the school private or public? If it's private, are you sure you need to go to a private school?

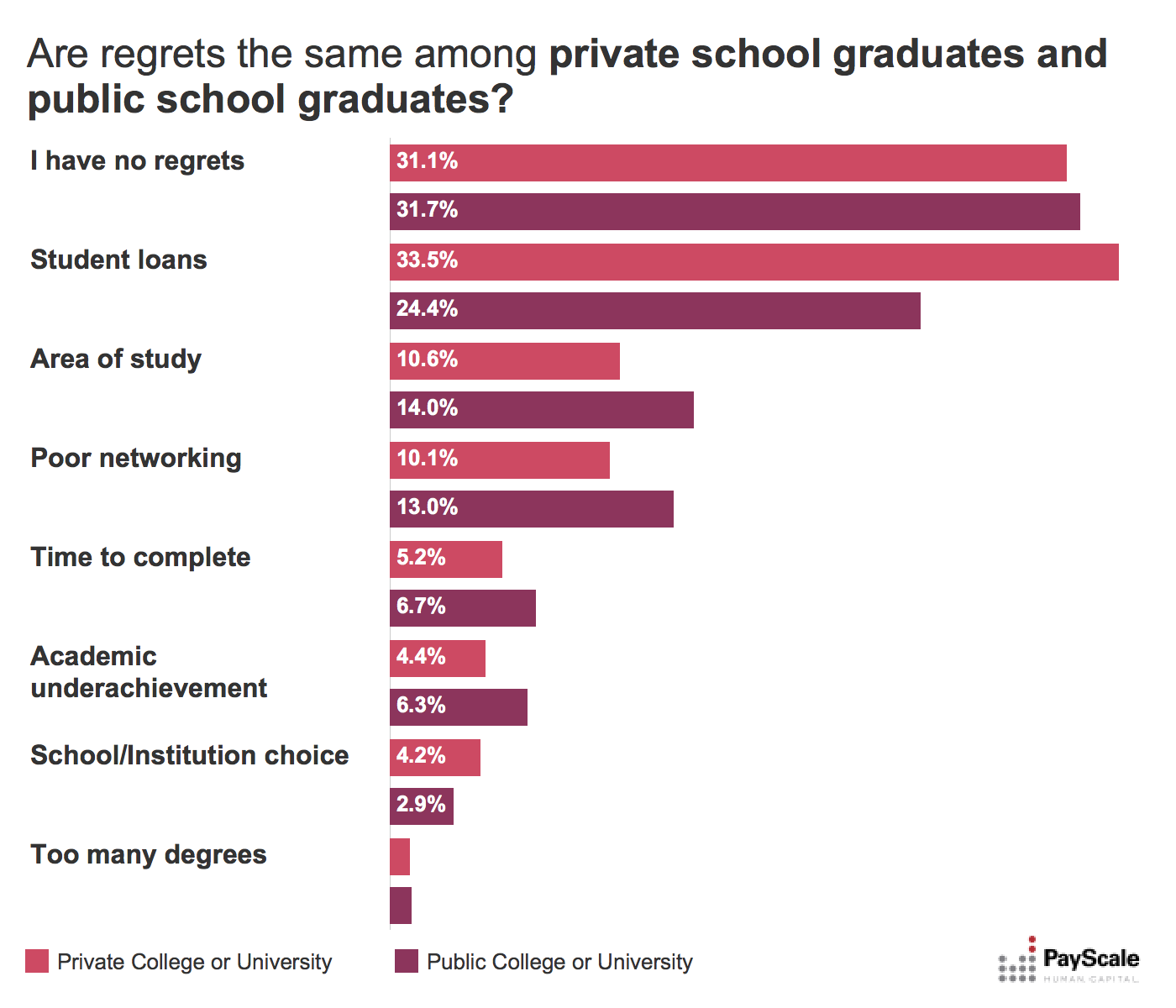

Private schools usually charge much higher tuition than in-state public colleges. That can often mean twice as much in loans, or more.

However, graduates of public colleges make just as much - if not more - than graduates of private colleges. And graduates of public and private colleges are about equally satisfied with their lives. Because of this, small private institutions are having greater trouble justifying their value.

Are you sure about what you want to major in?

Switching majors is one of the most common ways college plans are delayed. Changing majors can force you to graduate later, which means more money spent - and more unintended loans.

If you're not yet sure what you want to study, it's OK to take a bit of time to decide. One option option may be to take a gap year to think about your major.

What sort of job would you like to have?

You don't have to know for sure, but you should think a bit about the jobs you want to have.

A good rule of thumb is to not take out more loans than what the first year of income for your target job will be after graduating. Since standard student loans are over a 10 year repayment plan, this ensures that you won't have to put more than 10% of your salary towards paying back your loans. (For example, if you're majoring in Chemistry, avoid taking out more than $37,000 of loans, since that's the average starting salary for a Chemistry graduate.)

PayScale runs a website where you can look up first-year wages for different jobs. Make sure to check this before making any loan decisions - one of the most common mistakes students make is overestimating what their salary will be after graduating.

Where do you want to live after you graduate?

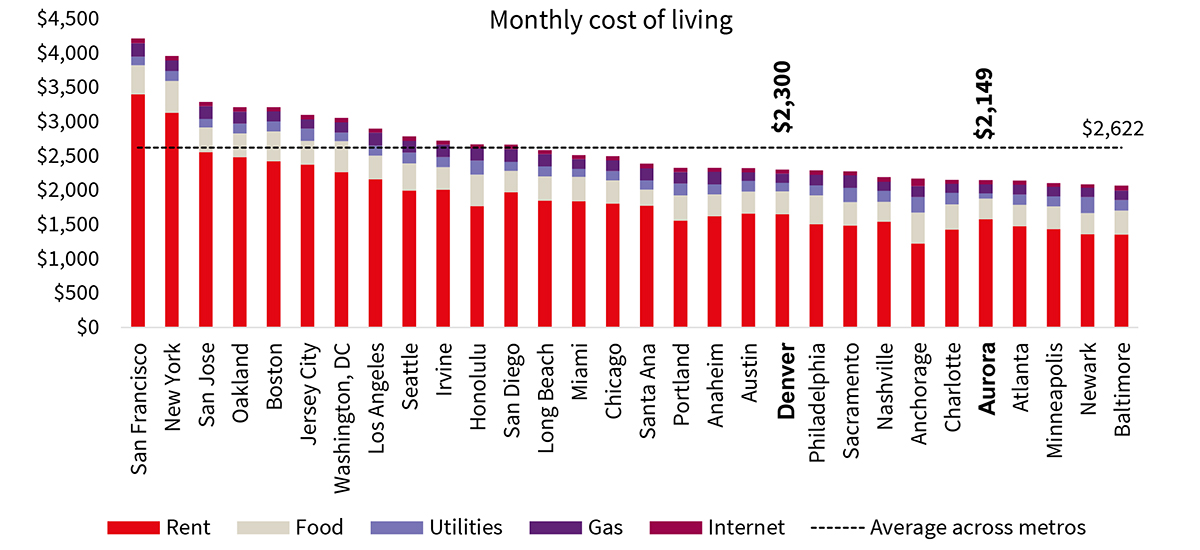

Cities vary dramatically in cost of living. For example, if you want to live in a place like New York or San Francisco after you graduate, you may need to take out fewer loans, major in a subject with higher return-on-investment, or attend a less expensive college to make doing so financially feasible.

You can compare cost of living in various cities here.

What are the details of the loan? Are there late fees? Can you defer payments?

Make sure you read through the fine print of any loan you plan to take out.

Many student loans can have predatory interest rates that force you to pay back way more than the amount you took out. Make sure to also pay attention to the expected payback period on the loan.

You should never plan on missing a payment. That's because missing payments can have harmful effects on other aspects of your life - such as reducing your credit score or increasing fees. That being said, you should still read up on what late fees and penalties the loan has, just in case.

Student loans are very hard to discharge in bankruptcy. That means it's almost impossible to have your loans forgiven if you can't pay them back. Only take out loans you are confident you will be able to pay back in the future.

Do you actually need student loans?

One of the most common mistakes students make is assuming they need to take out loans when they have other sources of funding available. See the Alternatives To Loans section.

Average student loan calculator

Select a few options and we'll break down how, on average, your loan might pan out.

I'm taking out student loans to go to a university for a -related degree.

On average, your degree will cost you around per year, or in total.

That's of debt.

On average, you'll make when you graduate.

That's about better than if you didn't go to college.

The average student loan has an interest rate of 6%. To pay back your loan in 10 years, you'll have to pay per month, or of your salary on average.

of people who got this degree said they had no regrets.

However, of people said they regretted taking out loans for this degree.

Alternatives to loans

Loans aren't always necessary, and sometimes they don't make sense to take. If you've found that it's not practical to take out loans to go to college, there are other options. Here are a few.

Scholarships and Student Grants

The federal government, state governments, and even colleges themselves provide grants and scholarships. These can range from merit-based scholarships to specific scholarships for students with financial need, minority students, female students, or students pursuing a specific major.

This option is incredibly underrated - there is a lot of potential free money that can help you pay for school. While these scholarships might not cover the full cost of college, they may be able to reduce the cost and let you take out fewer loans.

Most scholarships require an application. Applying for scholarships takes work - you'll have to spend time researching opportunities, filling applications, and crafting essays - but the result can be thousands of dollars to pay for college.

It's very important to apply on time. Most scholarships have deadlines in March of the year before you start college, but many require applying further in advance.

Here are a few of the best places to start looking for scholarships:

Cheaper college

Make sure to consider the price of each college when deciding where to apply and where to go. You can look up each college's expected price at TuitionTracker.com.

If you're thinking about going to a private college, consider a public college within your state instead. The average cost of a public college is $20,770 per year, as opposed to the much higher $46,950 that private colleges ask for.

Graduates of public colleges make just as much - if not more - than graduates of private colleges. And graduates of public and private colleges are about equally satisfied with their lives.

Adjust your intended field of study

If you find that you may have to take out lots of loans, it might be worth reconsidering your field of study. Since some fields have higher return-on-investment than others, some majors may let you more comfortably take out student loans.

Two websites where you can look up average salaries for various majors are Students Review and Job Search Intelligence.

Community college

Community colleges can be much cheaper than traditional colleges. The average tuition at a community college is $3,347 per year, as opposed to $9,139 at traditional four-year institutions. than half the cost of traditional colleges.

Many traditional colleges offer what's called a "2 plus 2" plan, in which you spend your first two years at a community college, and then finish your final two years at a traditional college. This can be a great way to save money and cut down on loan costs, while still letting you get a degree from an institution.

No college

It may not be necessary to go to college at all. Many people can find a fulfilling and well-paying job without a college education. While it's not the focus of this website, it may be worth considering what options are available without a degree.

There are also other reasonable alternatives to a college education. For example, apprenticeships let you learn on the job while being paid at the same time. Trade schools let you train hands-on for a specific job that often pays better than many college-requiring jobs.

I need advice

You're not alone. Thousands of students have to decide whether to take out student loans every year.

If you're considering taking out a loan:

-

This calculator can help you walk through a student loan repayment plan.

-

The student loans subreddit provides a place to talk to real people and get advice.

If you've already taken out a loan, and need advice:

-

The podcast Death, Sex & Money has put out a podcast answering common student loan questions. You can find it here.

-

The Institute of Student Loan Advisors (TISLA) gives fair, free student loan advice. You can get in touch with them here.

-

The Consumer Financial Protection Bureau provides advice on student loan forgiveness, refinancing, and repayment plans.

Common questions about this site

Why does this site exist?

Deciding to take out student loans is the single-most important financial decision students make before they're 30. But many students aren't given straightforward information on how to decide.

Students are told to think hard about getting into college, but often aren't told to think hard about return-on-investment for their degree, or how to avoid loan pitfalls. This results in many students becoming stuck in the "loan traps" - forced into debt they cannot repay.

This website hopes to provide advice for students thinking about accepting student loans.

This site is discouraging people from certain colleges or majors. Isn't that a bad thing?

This site does not seek to encourage or discourage anyone from going to a specific college or field of study. Its purpose is to instead inform students about the full financial picture involved with doing so, and mention warnings and alternatives.

If you change your major or college after reading this, that's not a bad thing: it may be better than making a financial decision you regret years after graduating.

College shouldn't just be a financial decision. Doesn't college also have intangible benefits?

It's true that a college degree provides many intangible benefits that can't be measured. But those benefits may not be worth struggling to make ends meet to pay back loans. That's the case for one in four college grads - 27% of graduates regret getting their college degree because of the student loans involved.

This site is not trying to discourage students from going to college - it is only trying to prevent students from taking out burdensome loans. It is likely still possible to go to college while avoiding harmful student loans: you can attend a cheaper college, switch to a major with a higher return on investment, or look for alternative sources of college funding.

How can I contact who made this?

Email degreepayoff@gmail.com with any questions, comments, or concerns.